Plant Based Food Market Revolution - WhitePaper

Future Market Insight published a whitepaper on the plant based food market titled, “The Plant Based Revolution: Growth Opportunities and Winning Strategies in the Global Plant based food market" in collaboration with Plant Based Food Industry Association (PBFIA). The report is based on opportunity analysis of the plant based food market and interviews with global and Indian players, to provide a holistic view on lucrative markets, ingredients scenario, key challenges this industry is facing and what could be the winning strategy for players in this ecosystem for transformative and sustained growth. Additionally, the study also maps prevailing trends in the plant based food market across multiple geographies.

The plant based food market has been growing exponentially since 2019, thanks to consumers’ changing food consuming choices. Millennials and Gen-Z are becoming conscious of the impact their food consumption choices have on the environment. Thus, they have shown a rising inclination towards plant based foods that are environmentally friendly in more ways than one.

According to Sentient Media, around 79 million people in the world are vegans. This, in turn, is changing the landscape of the plant based food market across the globe. Between 2020 and 2021, the number of vegans worldwide doubled from 0.5% of the global population to 3%. The COVID-19 pandemic played a key role in altering the food-consuming choices of people as more people focused on boosting immunity through organic food.

The global plant based food market predicted to witness explosive growth!

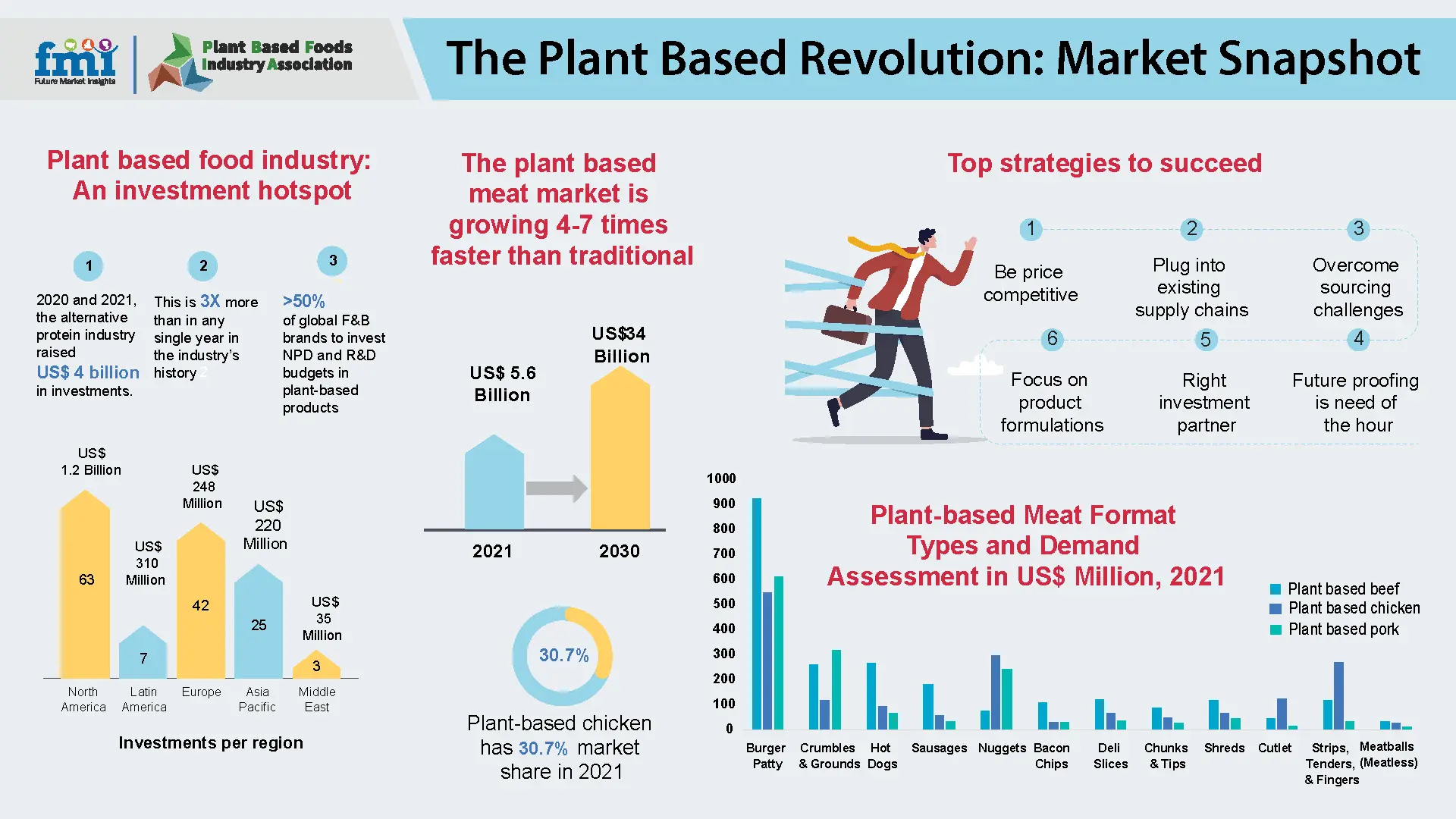

The Global meat and dairy sector is presently going through an unmatched level of disruption and competition! The growing turmoil in these sectors is driven by the evolution of plant-based alternatives across various segments. By the coming decade, it is predicted that ~20% of meat, eggs, and dairy eaten around the world is expected to be plant based. This shift towards plant based diet is evident and inevitable. This industry is going to witness a significant surge in growth with companies across the horizon investing heavily in R&D, new product development to bring out revolutionary plant-based products and creating a food system that is healthier, sustainable and affordable. Also, investments in the plant based market is at a record high, with US$ 4-5 billion raised in investments as on 2021 and 2020. This is three times more than in any single year in the industry’s history. While plant based meat, remains the largest segment with the highest interest, global investments in plant based seafood soared nearly two times in 2021, compared to 2020.

New product developments is also driving the industry forward, with more than 50% of global food and beverage brand owners likely to invest their new product development and R&D budgets in plant-based products.

Additionally, several global retailers are committed to increasing sales of plant based products, like Tesco will increase sales of meat alternatives by 300%, while Amazon Foods promised to widen its plant-based food sales in the years to come.

As environmental concerns take precedence, consumers are gravitating toward food, which are comparatively less polluting during their production. Currently, nearly 70% of global consumers opine that environmental health and how their choices influence the planet, are among the primary reasons why they would want to try plant based foods. Today, almost 1/3rd of all Americans have reduced their meat and dairy consumption, and consider themselves flexitarians. Consumers adopting flexitarian diets is only set to increase, with the overall consumer base expected to grow by 44% over the next few years. It is therefore easy to see why plant based foods is set to become mainstream across all continents reinforcing the fact that it is the next big food revolution!

How much is the global plant based food market valued at?

The global market for plant based foods that replace animal products including meat, eggs and dairy was valued at well over US$25 Billion in 2020, with the US market contributing over US$7-8 Billion. US remains the largest target market for plant based variants, while Europe shows steady growth. A dark horse in this industry is the APAC market which has been garnering steady investments particularly in plant based seafood.

Out of different product types, plant based milk has been around for sometime and is the largest market, also is quite mature across all regions. However, the growth for plant based milk is not going down anytime soon!

Plant based meat alternatives is gaining rising interest from flexitarians around the world. The global market for plant-based meat was valued at US$ 5.6 Billion in FY 2021, and is likely to surpass US$ 34 Billion by 2030, experiencing strong and sustained double digit growth at over 22% CAGR. The most prominent plant based meat category was beef alternatives which accounted for over two fifth of the global market share, and is expected to sustain its dominance, with its share increasing over the next 10 years. This is followed by plant-based chicken, at 30.7% market share in 2021. However, its share is likely to diminish as it reaches maturity and other categories picking up.

Plant based seafood, plant based eggs are still in their nascent stages and it will be sometime before they reach mainstream. However, there remains a significant ongoing opportunity for plant-based seafood, with an anticipated CAGR of 31.3% from 2022 to 2032 globally. The plant based seafood market also witnessed doubled investments in 2021 over the previous years.

Although meat substitutes together make less than 5% of their conventional meat market, the market is growing 4-7 times as fast as the traditional meat market. This increases the growth opportunity for the new players as well as existing players.

What are the driving forces for growth in Plant Based Foods?

- One of the main driving forces for growth is the investments pouring into this market and the continued interest seen among investors. The cash flow is enabling plant based brands to diversify their product lines, achieve economies of scale, widen their distribution channels to reach newer markets

- Rising consumer interest in Plant based meat products are a major driver of sales growth at grocery stores across the United States, growing nearly twice as fast as total food sales. The plant based meat market is rapidly expanding with sales in the retail sector increased by 45% in 2021 and 72% over the previous two years. With growing opportunities in global plant-based meat market, key companies are developing various new way-outs to enhance their sales in the retail sector.

- The growth of ecommerce and the foodservice sector has been an instrumental driving force for the plant based market. Existing trend analysis suggests that the foodservice market is the largest and the most profitable channel for sales, while the retail and grocery stores are yet to develop in terms of providing designated shelf space to plant based brands. Ecommerce and the D2C channels also preferred sales & distribution channels for plant based products

- The rise in new product launches is also a key growth driver for the industry as a whole as it has piqued consumer interest manifold, inspiring them to try different formats, flavors etc

Top players in plant based food market

Top players in plant based food market and disruptors are undoubtedly companies such as Beyond Meat and Impossible Foods. Several others are quickly catching up, such as:

- Planterra Foods

- Kerry Group

- Amys Kitchen

- Upside Foods (Memphis Meat)

- Ojah

- Finless Foods

- Sunfed Meats

- ChickP

- Quorn Foods

- Before the Butcher

- v2food

- Aspire Food Group

- Aleph Farms

These players are gaining a competitive advantage by expanding their plant-based product distribution and launching advertising efforts that highlight their diversity of possibilities. They are also devising strategic collaborations, joint venture agreements to gain competitive edge in this industry. A key example of such a partnership is the Beyond Meat and PepsiCo. joint venture agreement signed in January 2022 with the plan to launch plant-based Beyond Meat® Jerky as its first product. Furthermore, they announced the PLANeT Partnership, with the goal of creating plant-based snacks and drinks together. This partnership gives Beyond Meat, a chance to leverage Pepsi’s production and marketing expertise for new products. For its part, Pepsi can deepen its investment in plant-based categories while working with one of the top creators of meat substitutes.

As several leading plant based brands strive to consolidate their presence, emphasis is being laid on introducing new product lines, strengthening their supply chains, distribution networks and presence across traditional and online retail channels. But the most important competing factors are taste, texture that mimics or is better than animal meat, price parity with the animal industry, and availability. The winning brands would be the ones who are able to show fierce competitiveness on the above-mentioned factors.

Innovation in plant protein is driving the plant based market forward

Some plant proteins are mainstream and mature in their applications such as soy and peas which occupy 95% of the plant protein market owing to their availability, digestibility and protein density and neutral taste profile, however, plant based brand owners are under pressure to increase diversity of their alternative protein portfolio. Ingredient suppliers on the other hand are fast expanding their plant protein portfolio to include novel ingredients for additional claims such as allergen- free, organic, non GMO, high fiber, high protein among others. So what is the key criteria for selection? A lot of considerations goes into choosing the right fit plant protein which includes supply chain and sourcing ease, taste, formulation flexibility, nutrition, protein content, safety, sustainability, and consumer perception. Today AI is being used to screen plant sources for properties that can help mimic texture and behavior of dairy/meat based proteins. Also novel ways of processing the protein is being evaluated to improve functionality while maintaining safety, authenticity and durability.

Despite a rising interest in insect protein and cultured meat, these alternative protein markets will need more than a decade to grow into a fully commercialized success. Thus, plant-based proteins remain the most attractive with low production cost, high market penetration and strong in innovation!

Some of the leading plant protein or plant ingredient manufacturers are:

- ADM

- Axiom

- Cargill

- Dupont

- Ingredion

- Kerry

- Tate & Lyle

- Now Foods

- Rouquette

What are the key challenges this market is faced with?

Although there is substantial growth in the plant based food market, there are some serious challenges that are impeding this progress. Some of the significant obstacles are product formulations, raw material procurement, being price competitive, and a lack of sufficient capital.

Product formulations: Vegan customers are unconcerned about the texture and appearance of the items, whereas flexitarians are. Plant-based food products are evaluated by flexitarians based on appearance, taste, and texture, and this has set the level high for top plant-based food companies to make items that can mimic animal products. This necessitates a major effort on product creation strategies, enhancing ingredient functioning, and supplementing products with macro and micronutrients to deliver the same, if not more, nutritional value than animal products. As a result, the manufacturer faces numerous challenges during the plant-based product development process.

Raw material sourcing: Plant-based companies are currently concerned about sourcing concerns, including how to obtain enough raw ingredients. Aside from farm production delays, labor shortages, fluctuating demand, and logistical problems with processing and delivery, many brand owners are dealing with pandemic-related sourcing challenges. This presents a significant hurdle for growing plant-based food brands because ingredient acquisition is highly tailored and naturally more difficult.

Being price competitive: Plant-based food is thought to be more expensive due to the expenditures associated with R&D and ingredient procurement, and most companies in this field have relied on venture capital to fund their operations, which raises their costs even further. These elements have a direct impact on the product's price. Due to their current scale, plant-based meat enterprises also have the insufficient infrastructure. They lack infrastructure, facility design, manufacturing capability, and advanced technology. As a result, until costs are decreased, plant-based meat will remain a luxury product, preventing businesses from obtaining cost advantages.

Lack of sufficient capital: Due to the uniqueness of the plant-based food market, it requires significant investment, particularly in product development, R&D, and product sourcing. It would be impossible to develop products to compete with the animal market in terms of flavor, texture, quality, shelf life, or price parity without investment. Financing has proven to be a significant barrier, particularly for start-up enterprises in the plant-based food market. To prevent further losses, key players must first identify the core of these challenges and then design their strategies accordingly.

Strategic Recommendations for Top Players in Plant Based Food Market

Like any industry, the plant based sector is also riddled with challenges such as high capital investment, sourcing issues, supply chain shortages, high price competition with animal based industry. It is imperative that players in this ecosystem take cognizance of these challenges and work towards maneuvering them for sustainable growth. We highlight strategic recommendations in this white paper on how players in the plant based ecosystem can successfully work around these challenges.

Both start-ups and established market players must anticipate future supply or demand shocks, price fluctuations and other market uncertainties. Future-proofing is all about using flexible and scalable design strategies to protect against volatility and embracing new technologies and opportunities with minimal capital investment. Those who successfully future-proof their operations with flexible, innovation-friendly designs and processes will find this transition easier, faster, and more cost-effective.

With regard to Indian players, inadequate access is a concern. There are still pockets which remain significantly underfunded. Therefore, top players in domestic plant based food market are focusing on bringing in more venture capital funding, which is expected to solve most financing issues. In the past two years, the country has experienced spawning of major financiers, with players such as Ahimsa VC and Lever VC emerging as the front runners.

Currently, plant-based food companies are concerned about sourcing issues regarding raw ingredients. In addition to farm production bottlenecks, demand fluctuations, labor shortages, and logistical issues with processing and transportation, many brand owners are afflicted by pandemic-related sourcing issues. Furthermore, environmental conditions, such as drought or flooding, can destroy crops and lead to a shortage of raw ingredients. For plant-based brands, this can be a big loss. To offset such challenges, brand owners need to diversify their ingredient profile, at the same time form cooperatives with farmers in order to source sustainably.